The Gambling Animal

DR: The Gambling Animal, is a new book about deep risk and how humans gambled their way brazenly to planetary dominance.

GH: I’m Glenn Harrison, from the US, Australia, and Sweden

DR: And I’m Don Ross, from South Africa, Ireland, and Canada.

GH: We are economists who study responses to risk, using experiments with people, and recently elephants.

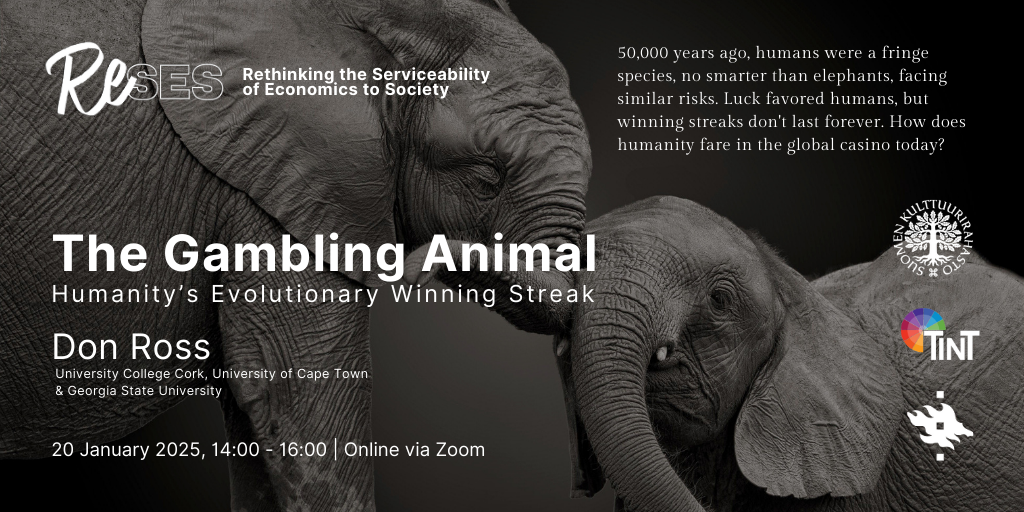

GH: Just 50,000 years ago humans were a fringe species, no smarter than elephants – there were 20,000 times more elephants in the world than people. The two species faced very similar risks. How did this turn completely upside-down so fast?

DR: Humans have been very lucky – so far. But as experienced gamblers know, winning streaks aren’t forever, and sometimes they end in disaster. How do things look for humanity in the global casino now? We invite you to read The Gambling Animal to find out!

Book launch

Helsinki Talk, The Gambling Animal, Humanity’s Evolutionary Winning Streak: video

News24: News24 interview

Business Day review: AI, elephants and communication frontiers.

Business Day review: The high-stakes, very human, nature of risk

PAGECAST – David Gorin in conversation with Don Ross: video